For most of the last decade the Rolex story was simple. Demand kept climbing while supply remained tight.

The brand makes a lot of watches, but not enough to satisfy a world that decided a steel sports model was the ultimate daily flex.

That imbalance hardened during the pandemic. Brief factory slowdowns met a tidal wave of stimulus cash, screen time, and social media status chasing. The waitlist went from long to mythical. Much like that “21 years” Audemars Piguet told us in Geneva. Pfffft.

RELATED: How To Clean Your Watch So It Sparkles

Curated news for men,

delivered to your inbox.

Join the DMARGE newsletter — Be the first to receive the latest news and exclusive stories on style, travel, luxury, cars, and watches. Straight to your inbox.

Authorised dealers became gatekeepers. Buyers spread spend across jewellery and dress pieces to improve their chances of landing a Submariner, GMT-Master II or Daytona.

The chase became part of the product. It felt like a private club where the cover charge was patience and purchase history. On the other side sat the grey market, which did not care about romance or loyalty. It priced watches in real time and made the premium impossible to ignore.

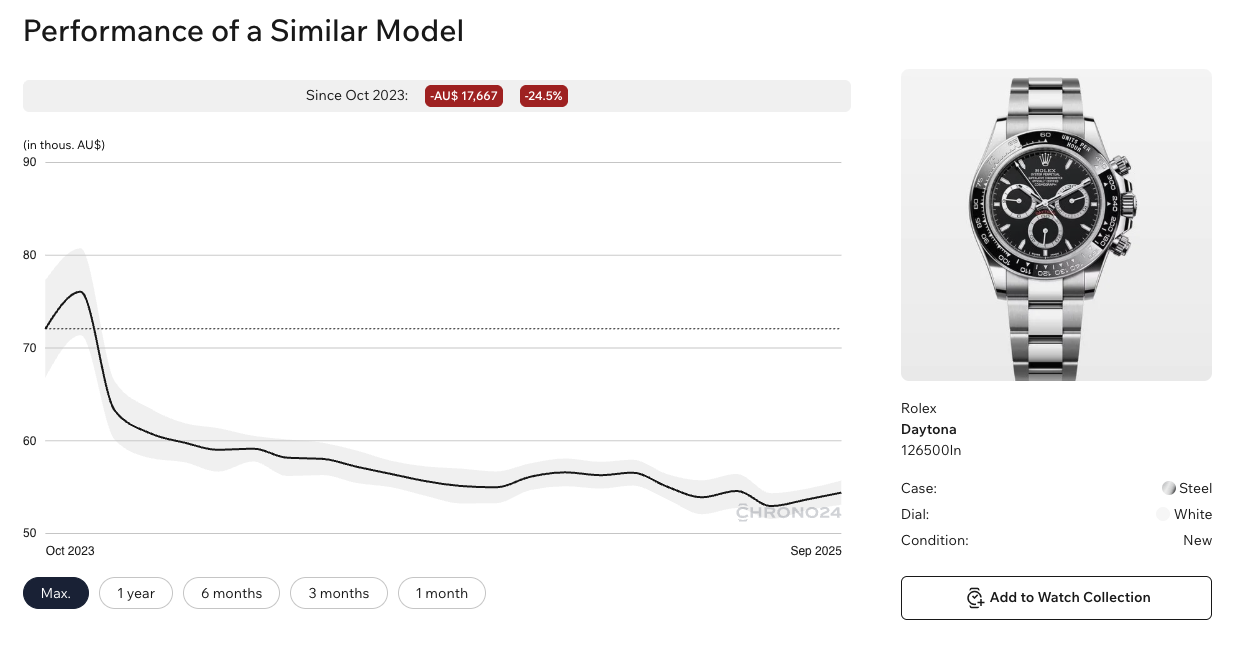

By 2020 to 2022, secondary prices detached from retail. A steel Daytona at list was a lottery win. Submariners, GMTs and Explorers sold above RRP the moment they left the boutique. Forums were full of fresh wrist shots followed by resale screenshots.

Crypto and tech wealth poured petrol on the fire. New money wanted instant signals and Rolex delivered them in a package even people outside watches understood. NFTs might have needed a TED Talk. A ceramic bezel did not. Everyone wanted in. Even I had to pull many a string to acquire a Pepsi GMT.

Prices rose because people believed they would keep rising. Liquidity from crypto gains, meme stocks and easy money kept the carousel spinning.

Then sentiment turned. Crypto crashed. Big tech pulled back. Interest rates rose.

Suddenly the buyer who would pay a forty to eighty percent premium for the privilege of owning a diver on Tuesday was happy to wait until Friday.

The grey market adjusted first. Inventory swelled. Ask prices slipped, then reset. Some references still commanded a lift over retail, but the everything-sells-above-list era was finished. That took heat out of the showroom too.

The power dynamic shifted from dealer to buyer, even if only by a few degrees.

None of this means Rolex started making far more watches or changed its strategy. It means the demand curve moved.

The psychological premium evaporated. People began questioning why they were paying extra for speed when speed was no longer part of the story.

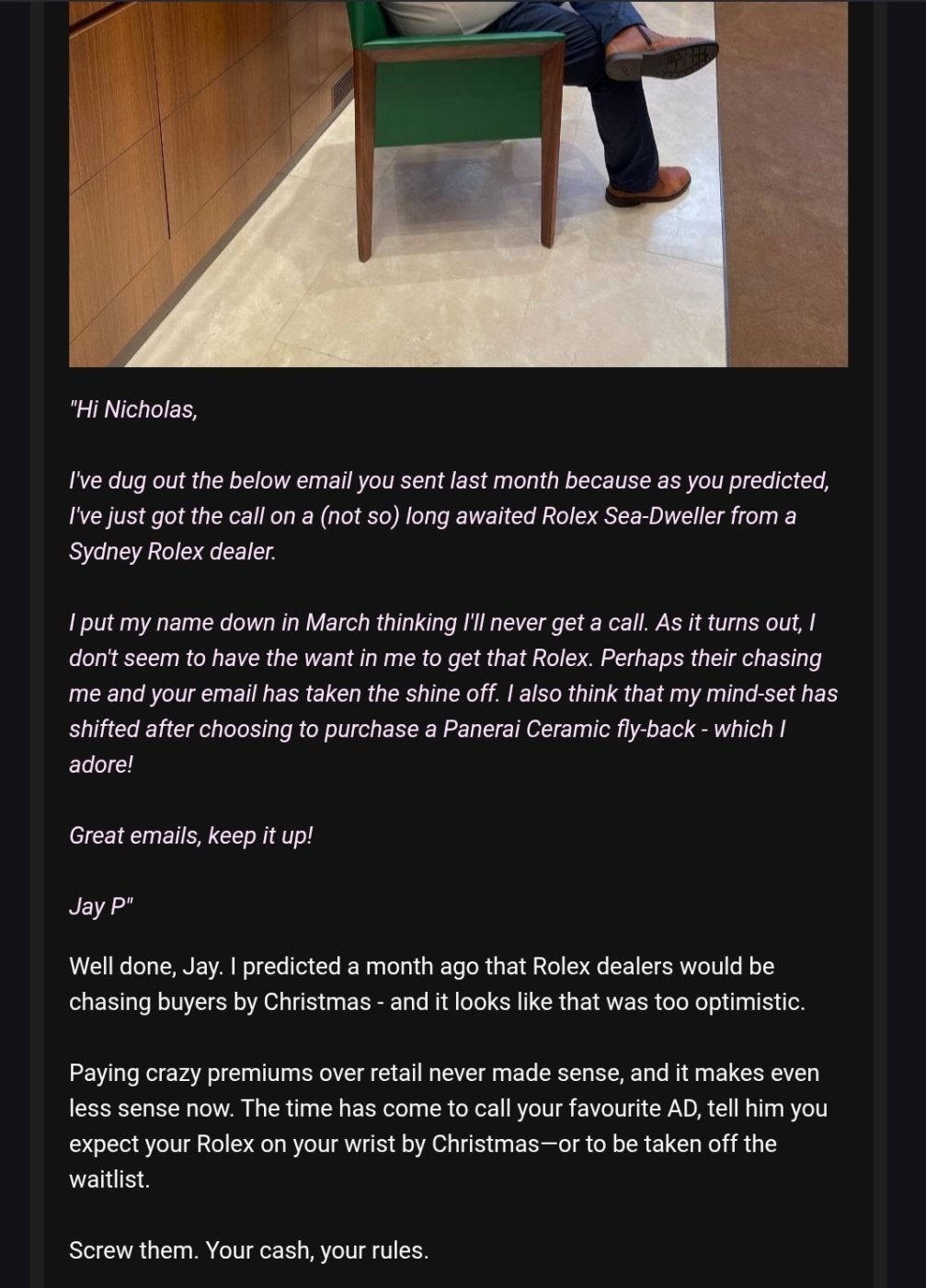

A buyer who once needed a Submariner to feel complete now looked at a Blancpain Fifty Fathoms Bathyscaphe, an Omega Seamaster, or, in the case of Nicholas Hacko’s reader, a Panerai Ceramic flyback and thought that was a more interesting use of funds.

What we are hearing locally supports that. Clients are receiving calls in months rather than years. This is only good news for the market.

The language has softened inside ADs. Follow-ups are more proactive. Pieces that once lived permanently in the safe are being offered to patient names on lists.

Grey dealers are still busy, but the quick flip is much harder. Paying above retail makes little sense when the official route is moving again. TBH, this softening of the grey market was well overdue.

YOU MAY LIKE: China May Ban Retractable Car Door Handles Over Safety Fears

It is worth remembering why demand rose in the first place. Rolex offers function, finish, and cultural weight that crosses borders. That will never change. When economic confidence returns, desire will sharpen quickly.

For now, the market feels rational. Buyers are thinking about value, not velocity. They are less moved by social media froth and more interested in the watch that suits their life, at the right time.

Which brings us back to that Sea-Dweller call arriving early.

In the boom, a buyer would have booked an Uber and run to the boutique. In this cycle, he pauses and looks at his wrist. I’ve been much the same. Do I really need that IWC Lake Tahoe at the moment? Not really.

For anyone who has been patient hoping for that call, this is the best development of all.

Want more breaking news and hot tips in watches – sign up to our newsletter.